CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bonds are set to cautiously rebound from last week’s losses after notching up gains for four sessions in a row. The market has reconciled to a slower pace of Federal Reserve interest rate cuts against the backdrop of steady growth and resilient labor market.

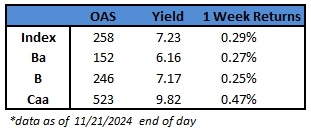

- Junk bonds rebounded across ratings, led by CCCs, the riskiest part of the high yield market. CCC yields plunged to a new low of 9.82%, the lowest since April 2022 and falling 25 basis points in four days. The risk premium for CCCs tumbled to 523 basis points, a three-year low, as spreads tightened for four consecutive sessions.

- CCCs are on track to be best performing asset class, with gains of 0.47% so far this week after rallying for four straight sessions.

- Tightening spreads, attractive yields, steady growth against the backdrop of easing interest-rates kept the primary markets busy, with eight companies together selling $4b in new bonds. The November tally is nearly $9b

- The broader index yields dropped six basis points this week so far to close at 7.23%. Spreads closed at 258 basis points, down eight basis points for the week

- The post-Thanksgiving period tends to be positive for risk assets, with spreads tightening in ten of the past fourteen years, Barclays strategists Brad Rogoff and Dominique Toublan wrote Friday. They expect similar performance this year. But tight starting spreads, elevated complacency, and some soft spots in earnings could limit the upside, they warn

- Though the momentum of the post-election rally faded, the slow but steady rebound this week on renewed expectations of less stringent regulations and lower taxes bolstered risk appetite, drawing high-risk pay-in-kind bonds in the primary market from RR Donnelley, commercial printing service provider.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.