CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bonds are headed for their sixth straight week of gains, and yields still hover around two-year lows on expectations that the Federal Reserve will begin easing interest-rate policy in its meeting next week. Expectations swing between a 25 and a 50 basis point cut.

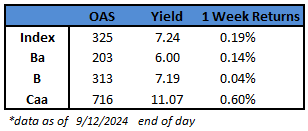

- The gains spanned across ratings in the US high yield market, led by CCCs, the riskiest segment of the market. CCCs are on track for their 11th week of gains, the longest winning streak in more than three years, after rallying for seven sessions in a row. CCC yields are at 11.07%, the lowest since May 2022.

- Expectations of easing monetary policy, combined with hopes of a soft landing, pulled US borrowers into the market. The primary market was crowded with 15 borrowers selling more than $11b this week, the busiest in four months. The busiest week this year is the week ended May 10 when the market priced $13b in new bonds

- 26 issuers sold bonds in the first two weeks of the month driving the September tally to $19b. The month already accounts for about 80% of last September’s volume

- The broad gains across risk assets pushed junk bond gains across ratings

- BB yields held steady at 6%. BBs are also set for their sixth weekly gains after rallying in two of the last four sessions

- With demand for all-in yield remaining robust and fundamentals appearing solid, any widening in yields will be met with buyers, keeping spreads range-bound, Brad Rogoff and Dominique Toublan wrote on Friday

- Fundamentals still look fine, with leverage in better shape than pre-COVID, Rogoff and others wrote

(Bloomberg) Core US Inflation Picks Up, Damping Odds of Outsize Fed Cut

- Underlying US inflation unexpectedly picked up in August on higher prices for housing and travel, undercutting the chances of an outsize Federal Reserve interest-rate cut next week.

- The so-called core consumer price index — which excludes food and energy costs — increased 0.3% from July, the most in four months, and 3.2% from a year ago, Bureau of Labor Statistics figures showed Wednesday.

- Economists see the core gauge as a better indicator of underlying inflation than the overall CPI. That measure climbed 0.2% from the prior month and 2.5% from a year ago in August, marking the fifth straight month the annual measure has eased and dragged down by cheaper gasoline prices.

- The BLS said shelter was “the main factor” in the overall advance.

- While Wednesday’s reading won’t deter the Fed from cutting interest rates next week, it reduces the chance of an outsize reduction. Even so, policymakers have made it clear that they’re highly focused on softness in the labor market, which is more likely to drive policy discussions and decisions in the months ahead. They’ll also have more data to consider leading up to their November and December meetings.

- In addition to shelter, the advance was boosted by airfares, apparel as well as daycare and preschool. Car insurance costs continued to rise, as did hotel stays.

- Shelter prices, the largest category within services, climbed 0.5%, the most since the start of the year. That marked the second month of acceleration and defied widespread expectations for a downshift. Owners’ equivalent rent — a subset of shelter and the biggest individual component of the CPI — rose at a similar pace.

- Excluding housing and energy, service prices advanced 0.3%, the most since April, according to Bloomberg calculations. While central bankers have stressed the importance of looking at such a metric when assessing the nation’s inflation trajectory, they compute it based on a separate index.

- That measure — known as the personal consumption expenditures price index — doesn’t put as much weight on shelter as the CPI does, partly why it’s trending closer to the Fed’s 2% target.

- The PCE measure, which will be released later this month, draws from the CPI as well as certain categories within the producer price index.

- Central bankers are increasingly paying attention to the labor side of their dual mandate amid emerging cracks in the job market. Hiring over the past three months is at the lowest since mid-2020, while job openings declined and layoffs rose in July. Anecdotally, employers have also indicated they’re becoming more selective in hiring, with some cutting hours and leaving vacancies unfilled.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.