CAM Investment Grade Weekly Insights

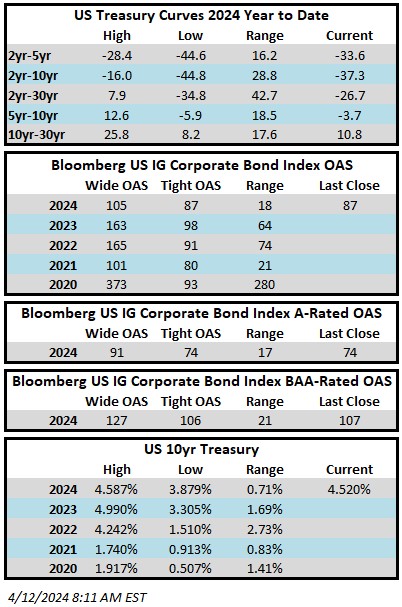

Spreads inched tighter during the week with the Bloomberg US Corporate Bond Index at its narrowest level of the year. The index closed at 87 on Thursday April 11 after having closed the week prior at 89. The 10yr is trading at 4.52% this Friday morning after closing last week at 4.40%. Through Thursday, the index YTD total return was -2.40% while the yield-to-maturity for the benchmark was 5.62% relative to its 5-year average of 3.65%.

Economics

It was an active week for economic data with the highlight of the week being another firmer than anticipated CPI print on Wednesday. This caused a sell-off in Treasuries with the 2-year leading the way as its yield finished the day 23bps higher. At the end of Wednesday, rates across the board were at the highest levels of 2024 but have since come off the highs and the entire curve is rallying to the tune of about 10bps as we go to print this Friday morning. These short term moves should not distract corporate bond investors from the bigger picture: this is an asset class that is well poised to deliver solid returns in the future, in our opinion. This entire year we have been saying that we felt that the bar was quite high for the Fed to begin cutting rates because the economy was simply too strong and the economic data too good. We were quite puzzled in January when interest rate futures were pricing 6 or 7 cuts despite a Fed dot plot that indicated 3 cuts at the median. The market has now come around to our view with futures pricing just shy of 2 cuts in 2024 as of this Friday morning. It is clear from its messaging that the Fed wants to cut and we know it is coming at some point. We believe that cuts would be a positive for our strategy as we think that it would be an important catalyst for Treasury curves to regain some upward positive slope. The Fed will cut when the data that it depends on will allow it to cut. It is as simple as that. In the interim, we believe that this backup in rates has created an opportunity for long term credit investors. We would not be surprised if we were to look back a year or two from now and long for the yields that are available to corporate credit investors today.

Issuance

Issuance was in-line with estimates on the week as companies priced $20.2bln of new debt. Next week dealers are estimating $30bln of new supply with banks leading the way as they report earnings and exit their blackout periods. Year-to-date issuance stands at $573.7bln, up 39% relative to 2023.

Flows

According to LSEG Lipper, for the week ended April 10, investment-grade bond funds reported a net inflow of +$3.2bln. This was the 17th consecutive weekly inflow for IG funds. YTD flows into IG stand at +$33.3bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.