CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

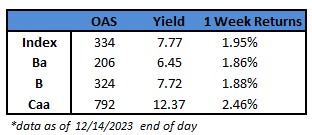

- US junk-bond yields plunged to a 10-month low and spreads dropped to a 20-month low after the Federal Reserve paused the most aggressive policy of raising interest rates for the third time in this week’s meeting, while also forecasting a series of rate cuts next year. Yields closed at 7.77% and spreads at 334 basis points. Junk bonds are headed for the fifth straight week of gains, with 1.95% returns week-to-date.

- The broad rally in high-yield bonds on news of the Fed pivoting to rate cuts spurred CCCs — the riskiest of junk debt — to post the biggest one-day gains in three years, with returns of 1.6% on Thursday. CCC yields tumbled 67 basis points to 12.37%, also a 10-month low. The demand for yield is not abating, Brad Rogoff and Dominique Toublan of Barclays wrote Friday morning.

- The rally in junk bonds, powered by a resilient economy and easing financial conditions, got further impetus from the Fed’s summary of economic projections. The central bank revised the growth forecast for 2023 to 2.6% from 2.1% it estimated in the September report.

- The Fed’s own quarterly projections showed it expects to lower rates by 75 basis points next year, a sharper pace of cuts than indicated in September.

- Bloomberg Economics expects rate cuts as early as March of next year.

- Gains in the US high-yield market were seen across ratings. Strong demand for credit to continue in the near-term, helping spreads grind tighter, Rogoff and Toublan wrote.

- The broader high-yield index racked up returns of 1.24% at close on Thursday.

- BB yields dropped 28 basis points to a 10-month low of 6.45% and spreads closed near a two-year low of 206 basis points.

- Single B yields fell 32 basis points to 7.72%, a 16-month low.

- Strong risk appetite, falling yields and spreads, and steady economic growth brought US borrowers into the market, driving new bond sales to $12b so far this month, already more than five times that of Dec. 2022.

- Issuance was predominantly for refinancing bonds and term loans.

- Most new sales priced at the lower end of price talk and drew orders of about three times the size of the offering.

- US junk bonds are poised to extend the rally on a broad risk-on sentiment after Chair Jerome Powell reinforced market expectations of a pivot to rate cuts.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.