CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- The US junk bond primary market has been inundated with new supply after a slow October, with companies selling almost $8 billion so far this week, making it the busiest since mid-September. Monthly volume has topped $9 billion, which is already about 96% of the total for all of October.

- Investors have poured new cash into the asset class since the Federal Reserve indicated last week that it was most likely finished with the most aggressive rate hike campaign in decades. US high yield funds reported a cash haul of $6.26 billion for the week ended Nov. 8, the third biggest on record. This was the first inflow into US junk bond funds in nine weeks, according to Refinitiv Lipper data.

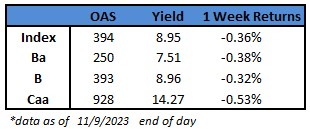

- A rush of borrowers came to take advantage of the current risk-on mood as yields fell 54 basis points in just seven sessions this month to 8.95%. Spreads were down 43 basis points.

- More borrowers are expected to capitalize on the broad risk-on sentiment and refinance a chunk of 2025 notes as companies steadily chip away at the so-called maturity wall of near-term debt. Companies are also repaying some term loans.

- This sudden rush of supply and a change of tone and messaging from Fed officials this week caused concerns about the possibility of another 25 basis-point increase in interest rates and a potential further delay of a possible rate cut.

- Yields rose eight basis points on Thursday to 8.95%, fueled by a 13 basis-point jump in yields for CCCs, the riskiest of junk bonds.

- US junk bonds are headed toward a modest weekly loss of 0.36% after a loss of 0.26% on Thursday, the biggest one-day loss in three weeks.

- The losses came after Fed Chair Powell cautioned that the central bank won’t hesitate to tighten policy further if needed to contain inflation.

- Federal Reserve Governor Michelle Bowman repeated that while she supported the central bank’s decision to keep rates unchanged at last week’s meeting, she still expects policymakers will need to raise interest rates more to contain inflation.

- Federal Reserve Bank of Richmond President Thomas Barkin says “the job isn’t done” to get inflation back to the central bank’s 2% target, and slower demand will likely be required to achieve that goal.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.