CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

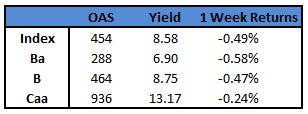

- US junk bonds are set to lose this week by the most in six weeks, ending a month long rally as investors brace for at least one more interest rate hike by the Federal Reserve. Yields in the risky debt jumped by 18 basis points this week to 8.58%, the highest since late March. For traders, the risk is that higher-for-longer rates will expedite recession. An uptick in US jobless claims hinted at some softening in the US labor market, while a gauge of manufacturing activity in the Philadelphia area fell to the lowest level since May 2020.

- Junk bond spreads widened to +454. Spreads rose and the junk bonds posted negative returns in three of the last four sessions.

- The losses in the US junk bond market spanned all ratings. BBs are on track for a weekly loss of 0.58%, the biggest since the week ended March 10. Yields closed Thursday at 6.90%, a three-week high.

- While large cap bank earnings have been fine so far, recent data suggest economic weakness in the manufacturing, Barclays’s Brad Rogoff wrote this morning.

- US high yield funds reported a cash haul of more than $3b for the week ended April 19, a third week of inflows. Two of the past three weeks saw an inflow of more than $3b.

- The US junk bond primary market has seen a steady stream of borrowers.

- Borrowers are rushing in ahead of the next Fed meeting as they wait for some hints on the future path of the monetary policy after a widely expected 25bps hike.

- Month-to-date issuance volume has jumped to $14b and year-to-date supply is at $53b.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.