CAM Investment Grade Weekly Insights

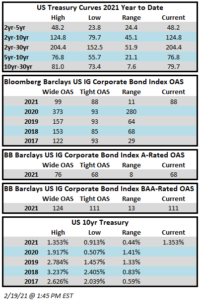

Spreads continued their slow burn this week, gradually inching tighter. The OAS on the Bloomberg Barclays Corporate Index closed at 88 on Thursday evening after ending the week prior at 92. Treasuries are at their highest levels of the year for the second consecutive week. The 10yr Treasury closed last week at 1.21% and it is trading at 1.35% as we go to print this Friday afternoon. Through Thursday, the corporate index had posted a year-to-date total return of -2.07% and an excess return over the same time period of +0.83%.

The high grade primary market was light during the holiday shortened week with only $14bln in new issuance. Concensus estimates for next week are calling for $30-$40bln in new issuance, according to Bloomberg surveillance.

Per data compiled by Wells Fargo, inflows into investment grade credit for the week of February 11-17 were +$7.6bln which brings the year-to-date total to +$73bln.

Price action in Treasuries the past two weeks has been wrapped around investor views of stimulus and inflation. As vaccinations increase and infections decrease, global economies can be expected to exit their slumber. We think there is a consensus among market participants that inflation is likely to increase throughout 2021 and into 2022 but we are of the view that there is much uncertainty regarding the degree of the relfation trade. There are numerous areas of the economy that could take years to recover while there are some sectors that have already recovered and those that will bounce back even stronger. Are sustainable broad based price increases across the vast majority of the economy possible? Anything is possible, but we would argue that an extraordinarily robust recovery over a short time period is unlikely – but let’s assume this does come to fruition. While the Fed has said it would tolerate temporary inflation above its targeted level, if it were to view this as something more than fleeting, and if it were to view the economy as “overheating” then it could well accelerate the timeline for raising the Fed Funds Rate. A higher Fed Funds Rate typically leads to tighter financial conditions and slowing growth, which would put a brake on any reflation trade. The point is that yes, we think reflation is likely, especially in certain sectors of the economy. But even if the domestic economy were to recover much more quickly than expected, we are skeptical that the Fed will allow significant levels of inflation without Fed Policy intervention.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.