CAM Investment Grade Weekly Insights

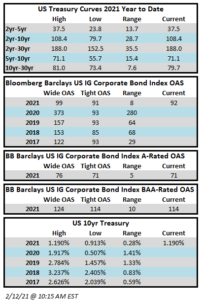

Spreads initially ripped tighter on Monday of this week before giving back some gains, but it looks like the index will still end the week tighter, or at worst, unchanged. The OAS on the Bloomberg Barclays Corporate Index closed at 92 on Thursday evening after ending the week prior at 93. Treasuries are at their highest levels of the year across the board and curves continue to steepen. The 10yr Treasury closed last week at 1.16% and it is hovering around 1.19% as we go to print on this Friday morning. Through Thursday, the corporate index had posted a year-to-date total return of -1.45% and an excess return over the same time period of +0.49%.

The high grade primary market was more subdued this week with only $16bln in new issuance. Next week, too, may see lower volumes with the market closed for Presidents Day on Monday, but midway through February we are on pace for $120bln of issuance which is quite a strong number.

According to data compiled by Wells Fargo, inflows into investment grade credit for the week of February 4-10 were +$2.1bln which brings the year-to-date total to +$40bln.

In our recent discussions with some of our clients, the topic of inflation and rising rates has been coming up with increasing frequency. We have long warned of the folly of trying to predict moves in interest rates. That is one of the reasons that we always position our portfolio in intermediate maturities rather than attempting to tactically switch between long and short maturities based on our guess as to the direction of rates. To put recent rate moves into context, the 10yr Treasury closed at 0.51% on August 4, 2020 and it has more than doubled since then, closing at 1.18% on February 11, 2021. If we look at returns for the Corporate Index over this same time frame you may be surprised to learn that the total return for the index was only modestly negative at -0.38% total return; and you would be hard pressed to cherry pick a worse timeframe for returns from a rate presepective! The reason that corporate credit returns can be relatively resilient in the face of rising rates is due to the power of spread compression and coupon income. Over that same period the index saw its spread compress from 131 to 92 and then investors also earned a coupon from corporate credit that was greater than the coupon earned from investing in duration matched Treasuries. Could rates continue to go higher from here? Yes of course they could, just as they could go lower. But we would be surprised to see them go materially higher in the near term as our expectations for inflation remain relatively subdued relative to what seems to be a growing market concensus. We will explore some of the reasons why inflation is not necessarily something investors should bank on in our future weekly commentaries. Thank you for your interest and continued support.