CAM Investment Grade Weekly Insights

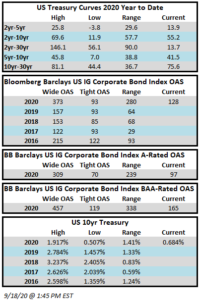

Spreads are slightly tighter on the week. The Bloomberg Barclays US Corporate Index closed on Thursday September 17 at 128 after closing the week prior at 130. Spreads have traded in a very narrow range over the course of the last month, with the OAS on the index never closing wider than 131 or tighter than 126 since the week of August 17, with numerous ups and downs within that tight range. Through Thursday, the corporate index has posted a year-to-date total return of +7.43%. The FOMC was on the tape Wednesday, signaling that rates will remain near zero through 2023, and there was little movement in Treasuries throughout the week.

The high grade primary market was active again, with $42bln in new debt issued, though this was down considerably versus the prior week. Next week is expected to be slightly less busy, with syndicate supply forecasts weighing in at $30-$35bln. The pace of issuance should continue to subside as we approach quarter end.

According to data compiled by Wells Fargo, inflows into investment grade credit for the week of September 10-16 were +$4.5bln which brings the year-to-date total to +$196bln. This was the 23rd consecutive week of inflows into the investment grade corporate bond market.