CAM Investment Grade Weekly Insights

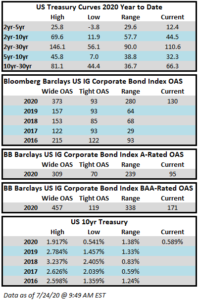

Spreads look to finish the week tighter again as the grind lower continues. The Bloomberg Barclays US Corporate Index closed on Thursday July 23 at 130 after closing the week of July 13-17 at 136. The return on the corporate index keeps inching higher with a year-to-date total return of +8.28% through Thursday. This week saw spreads move tighter throughout as we are now firmly in the midst of earnings season meaning supply has come to a standstill. Additionally, dealer inventories are near historic lows which has made it a sellers’ market, with offerings few and far between. Rates have continued to inch lower in recent weeks and the 10yr sits within 5 basis points of its year-to-date lows.

The high grade primary market was extremely quiet this week with just $6.6bln in new supply. This is typical in the midst of summer and during earnings season but it is fair to say that it was even slower than expected given most dealer projections were pegging supply in the $15-$20bln range. Issuance should be subdued again next week but could pick up in mid-August if the macro-tone remains friendly to issuers.

According to data compiled by Wells Fargo, inflows for the week of July 16-22 were +$11.1bln which brings the year-to-date total to +$82.7bln.