2022 Q2 Investment Grade Quarterly

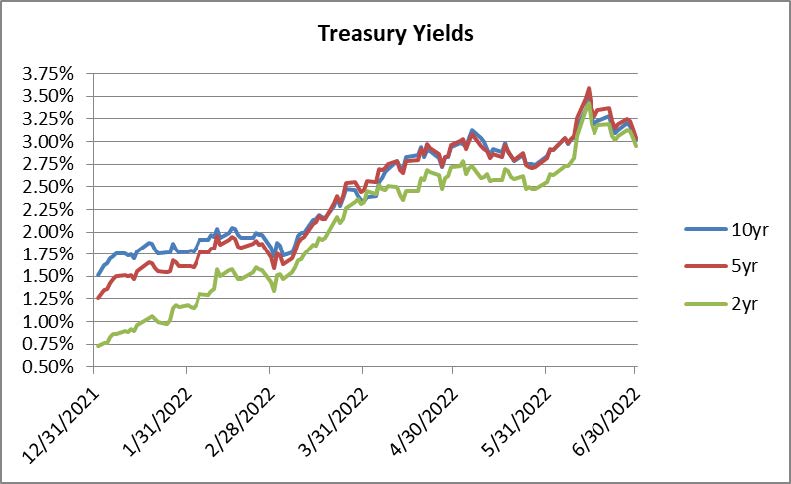

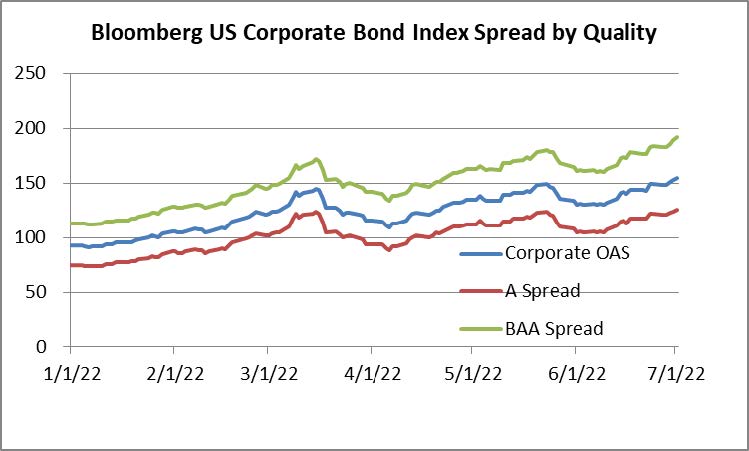

The second quarter was another extraordinarily difficult period of performance for investment grade corporate credit. Treasury yields continued to march higher and credit spreads moved wider. The option adjusted spread (OAS) on the Bloomberg US Corporate Bond Index widened by 39 basis points to 155 after having opened the quarter at an OAS of 116. The 10yr Treasury opened the quarter at 2.34% and finished 67 basis points higher, at 3.01%. The 5yr Treasury opened the quarter at 2.46% and finished 58 basis points higher, at 3.04%. The 2yr Treasury opened the quarter at 2.33% and finished 62 basis points higher, at 2.95%. Some sections of the Treasury curve were inverted throughout the quarter which historically has been one of the leading indicators of a recession.

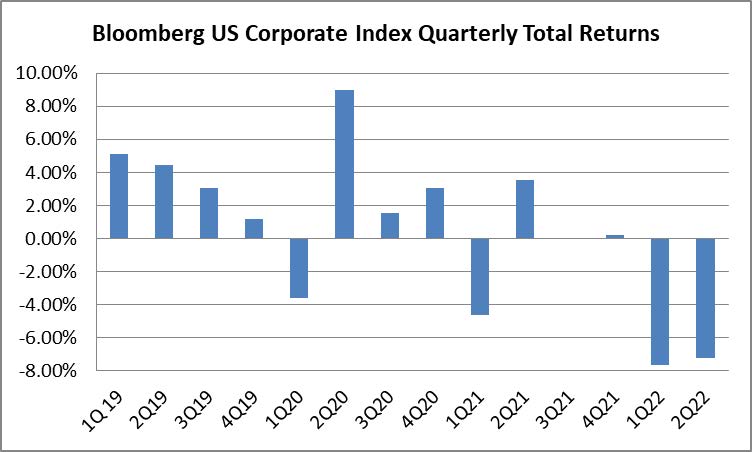

The Corporate Index posted a second quarter total return of –7.26%. CAM’s Investment Grade portfolio net of fees total return for the second quarter was –6.02%.

As much as it pains us and our investors to experience consecutive quarters of negative performance, not all hope is lost for investment grade returns in the future. The asset class has seen a meaningful drawdown and overwhelming negative sentiment has been priced into current valuations in our view. Higher Treasury yields and wider spreads have left investors with a much larger margin of safety in the asset class than there has been at any point in the past decade. We will discuss our views on where the market could go from here in the ensuing sections of this letter.

Is The Worst Over?

We have just endured a historically poor period of performance. The past two quarters were 2 of the 3 worst quarters in the history of the investment grade credit market and represent the worst 6 month performance period for the asset class. Looking at the bigger picture–we are talking about a brief time period of only six months. This asset class is not one that lends itself to tactical positioning and is more appropriate to view through the lens of a longer time horizon. That is why we tell our investors that a minimum time horizon of 3 to 5 years is needed to give our strategy the best chance of success. This is because the lynchpin of our strategy involves the intermediate Treasury and corporate credit curves. We typically purchase securities that mature in 8-10 years and look to sell those securities when they have 4-5 years left to maturity, redeploying those proceeds into attractive opportunities back further out the curve in the 8-10yr space. As bonds “roll down the curve” the bond math acts like water, finding its lowest level. All else being equal with rates and spreads, the price of a bond will move closer to par with each passing day of its existence. Bonds that have declined in value will start to recover with the passage of time as the time to maturity shortens.

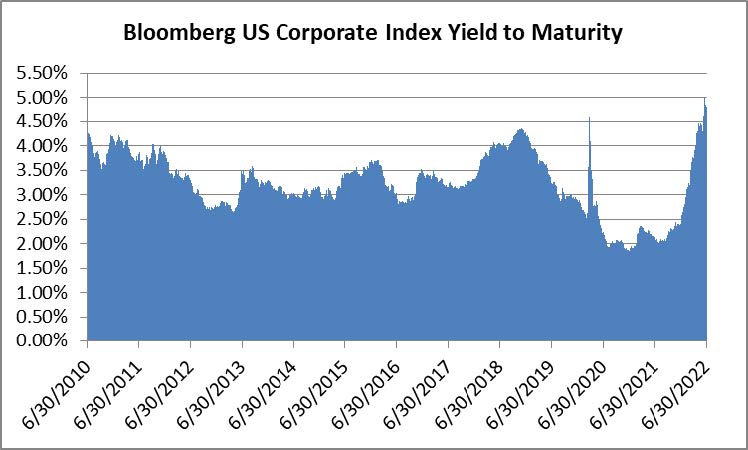

As we mentioned in the opening section of this letter, the compensation afforded for credit spread and the underlying Treasury is much more than it has been in recent history. The index closed the second quarter at a spread of 155 relative to the 10yr average spread of 126. To provide some context on the rate of change over the course of the past year, on June 30 2021, the index closed at a spread of 80, which was its lowest level at any point in the past decade. As far as yield to maturity is concerned, the yield on the index was 4.71% at the end of the second quarter while the 10yr average was 3.09%. The index recently closed with its highest yield at any point in the past decade on June 14 2022, when it finished the day at 4.99%.

Now, we often caution against market timing and quite frankly we were wrong about valuations at the end of the first quarter because we thought they were relatively attractive at that point in time. Our valuation thesis crumbled throughout the second quarter while we watched rates continue to move higher and spreads traded wider due to macroeconomic concerns. This brings us to the question–can things get worse from here with higher rates and wider spreads? Absolutely, it could happen, and of course the opposite could come true as well and the market could see positive performance. What will happen over the short term is merely a guess. From a longer term point of view what we do know is that there is no denying that there is substantially more room for error for investors in investment grade corporate credit than there has been in a long time. We believe the Band-Aid has been ripped off at this point and that going forward we are much less likely to see a repeat of the eye watering negative returns that we saw in the first two quarters. Instead, we think the level of compensation afforded today sets up well for the potential to drive positive total returns for IG credit in the future over the medium and longer term.

Credit Conditions

Credit conditions for the investment grade universe remain strong, especially for the mostly highly rated companies, but conditions have declined so far this year and at this point it is clear that year-end-2021 was the peak for credit conditions in this cycle. Major factors that have led to the decline are higher borrowing costs due to rising interest rates and wider spreads. Inflationary pressures have also started to squeeze profit margins as companies are not able to pass the entirety of rising costs on to their customers. Inventory build and discounting have started to appear in some pockets of retail. Consumer confidence has slipped which historically has been a leading indicator of a slowdown in consumer spending.

Credit investors have begun to tread with caution as the majority of economists now expect a recession by the end of 2023.i The new issue market has slowed substantially in recent weeks amid volatility across risk assets. The market remains open for borrowers but investors are now demanding larger new issue concessions. This can present opportunities for bond investors as even very strongly capitalized highly rated companies will be forced to pay attractive new issue concessions in the current environment. This means higher coupons for investors. The key for a bond investor is to resist the temptation of the optically high yields offered by those companies that don’t have good balance sheets or those that trade at levels that do not offer adequate compensation for the risk. We are at a fairly interesting crossroads in the market where the prudently capitalized companies in the IG universe do not find themselves in a position where they “need” to borrow and we believe many of the companies that we follow would have likely issued new debt recently but simply decided not to because they don’t need the capital and more expensive borrowing costs have made raising new debt less attractive. On the other side of the coin are those companies that engaged in M&A or debt funded capital projects or shareholder rewards prior to the increase in borrowing costs. These CFOs and treasurers find themselves in the unenviable position of needing to borrow in a volatile market and trying to best gauge when to issue bonds. Some of these companies will be required to pay outsized new issue concessions in order to complete their bond offerings. Again, this could mean opportunity in select credits but some of the new deals simply won’t be cheap enough to offer adequate compensation for the risk. So what we find ourselves with today is a market that is highly bifurcated. For the vast majority of IG-rated companies, liquidity and cash on balance sheet remains near all-time highs and leverage is at very reasonable levels. For some other companies, they might have too much debt and the business and balance sheet are subsequently poorly positioned for an economic slowdown. In a recession scenario, many of the well capitalized companies will see margins contract and could see sales decline–but their balance sheets are in good shape and they are not over-levered so they will navigate a downturn just fine and easily make good on their commitment to pay bondholders while keeping their current credit ratings. For those companies that have too much debt and are also faced with declining revenues and profits –it could be a bumpy road during an economic slowdown and there will likely be some companies that see their bonds downgraded to junk. It is our job to manage the credit risk of the portfolio and avoid companies that are at risk of seeing their credit metrics decline precipitously. In a recession scenario, due to the strength of the highly rated, well capitalized portion of the investment grade universe, we believe investment grade credit will perform better than most other asset classes.

Portfolio Positioning

As an active manager we have been able to make what we felt were many opportunistic trades amid the market volatility of the past few weeks. To be clear, we will never make wholesale changes to our strategy but we will always tinker at the margins depending on the environment in our market at any given time. The Holy Grail for bond performance has three tenets –decrease maturity, increase yield and increase or maintain credit quality. If a manager can affect a trade that accomplishes all three, then it is likely to be successful over time. Currently, the biggest change to our management style is that the dislocation in the market has created opportunities for us to buy shorter maturities than we typically would. Intermediate Treasury curves were flat or inverted throughout most of the second quarter, depending on the day. The corporate credit curve still has a level of steepness but due to the nature of the way that the bond market trades–over the counter, price discovery and no exchange like equities, it can create attractive scenarios where a manager is able to buy shorter duration bonds of an issuer at levels that are more attractive than the longer bonds–a situation that should not exist in an efficient market–but the bond market is not always efficient. We have been able to populate investor portfolios with many more bonds that mature in 7 or 8 years (or even less in some cases) whereas in more normalized periods with steeper Treasury and corporate credit curves the math would favor 9-10 year bonds. All else being equal, a shorter maturity means less interest rate and credit risk for our investors. Note that we will always stick to our mandate of intermediate maturities.

In addition to being able to position more conservatively from a duration standpoint, we are also being cautious with credit risk. Credit health is still quite good for many issuers even if some companies have begun to experience a slight decline in margins and profitability. At the moment we are avoiding more cyclical credits in favor of stability. As investors have started to factor in the increasing probability of a recession, the spread gap between lower rated and higher rated credit has grown, and lower rated has performed relatively worse. We see select opportunities in BAA-rated credit but continue to limit our exposure to 30% of investor portfolios while the index was 49.53% BAA-rated at the end of the second quarter. We will not be increasing our weighting to riskier credit and our preference for lower rated credits at the moment is limited to those companies that have stable or improving credit metrics or those that are in the process of deleveraging. As far as A-rated companies are concerned, they will continue to make up approximately 70% of investor portfolios and we are favoring industries like utilities and highly rated energy companies. We also like non-discretionary healthcare and technology companies that will continue to grow earnings regardless of the economic environment. We believe that the risk of recession has increased substantially and are looking to populate portfolios with companies that can navigate an environment of negative growth with little impact to credit worthiness.

Hawks & Doves

During the second quarter the Federal Reserve made it abundantly clear that they were focused on conquering inflation as they delivered a 50bps hike in May followed by a 75bps hike in June. The next FOMC rate decision is July 27 and Chairman Powell has messaged that 50-75bps will be on the menu, depending on the economic data over the course of the next few weeks. Recent economic data has indicated an increasing possibility of a slowing economy and traders are now pricing in 50bps of rate cuts in 2023. Current projections foresee a peak for Fed Funds of ~3.3% in early 2023 up from 1.75% today with a prediction that the benchmark rate will be 2.7% at year-end 2023.ii What this means is that traders are predicting a recession by mid-2023 as that would be the catalyst for a rate cut in the second half of next year. Inflation is not a problem unique to the U.S. and a myriad of central banks have joined the Fed in the quest to quell rising prices. Australia, Canada, New Zealand and Switzerland have raised their policy rates in recent weeks and even the reticent ECB has signaled a series of rate hikes that will begin in July.iii As a result, the amount of global negative yielding debt has tumbled from nearly $17 trillion in August of 2021 to just over $2 trillion at the end of the second quarter. The Bank of Japan is the only major central bank that has resisted tightening financial conditions.

Our job is to manage credit risk, not to speculate on rates or try and predict the Fed’s next move. That doesn’t mean we don’t care, just that our time is better spent on studying individual companies and their creditworthiness and not trying to predict the next move of a central bank as it is very much a game of chance. What we do know is that the economic data that the Fed uses to guide its policy decisions is backward looking in nature, not forward looking. Regardless of how much the Fed raises its policy rate, it seems likely that it will do so until it overshoots, finding itself in a situation where it raises the policy rate during the early stages of a U.S. recession. In other words, the Fed will be hawkish until it isn’t, and it will continue to tighten financial conditions until inflation is no longer a problem. What does this mean for credit? If there is a recession it could mean wider credit spreads. We plan to position the portfolio accordingly and with the type of companies that can weather an economic downturn.

Making the Turn

We are more than halfway through 2022 and there are more risks for credit today than when we started the year. The good news is that much of this bad news has been priced into valuations. This has created opportunity in our view but we will continue to be diligent and screen each of our investments carefully. Now is not the time to reach for yield, but to invest in the bonds of those companies that are well positioned and allocate capital in a creditor-friendly manner. We will be doing our very best to pick those investments that have the best chance to generate positive returns for our investors. We thank you for your patience during this turbulent time. As always we encourage you to contact us with questions. Thank you for your interest and partnership.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that the investment decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

i Fortune, June 13 2022, “Over two thirds of economists believe a recession is likely to hit in 2023”

ii Bloomberg, July 5 2022, “Traders looking to get ahead of Fed again foresee rate cuts”

iii Reuters, June 10 2022, “Central banks double down in fight against ‘galloping’ inflation”