CAM High Yield Weekly Insights

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$1.1 billion and year to date flows stand at -$35.8 billion. New issuance for the week was $1.2 billion and year to date issuance is at $56.9 billion.

(Bloomberg) High Yield Market Highlights

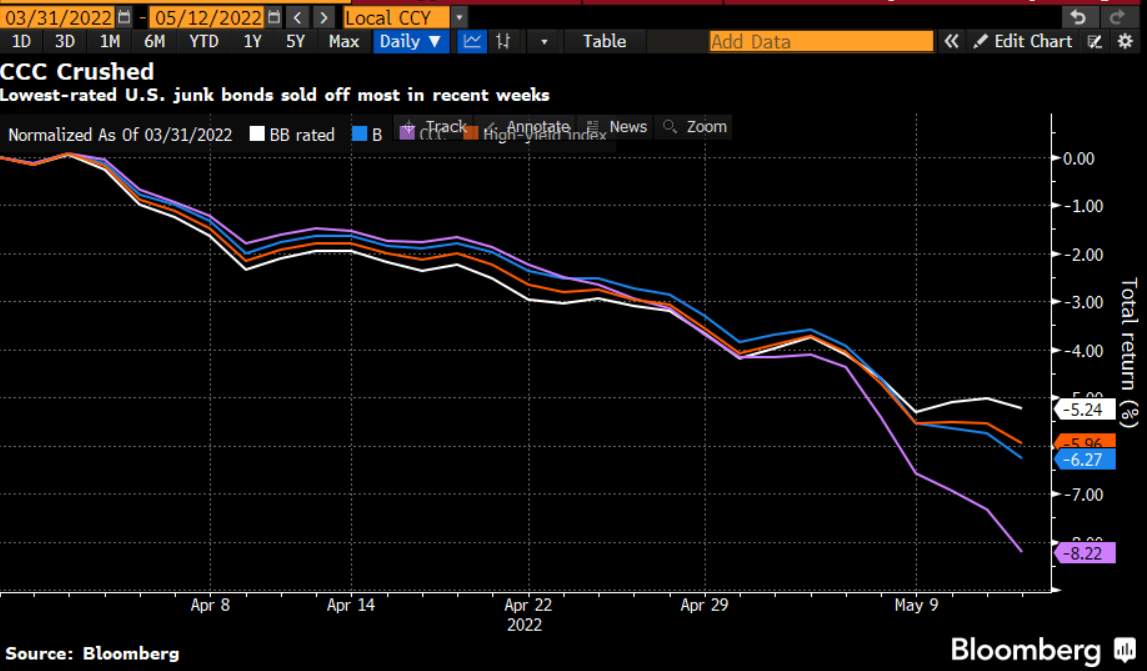

- U.S. junk bonds are headed for the biggest loss in five weeks as yields veer toward a fresh two-year high of 7.62% and spreads to an 18-month high of +458bps. It will mark the sixth straight weekly loss, the longest losing streak since December 2015. The losses spanned the ratings spectrum. CCC-grade bonds, the riskiest part of the market, are expected to post a loss of almost 3% for the week, the worst in the high yield market.

- The downturn was primarily driven by rate fears that were fueled by US inflation data that bolstered the case for more aggressive monetary tightening by the Federal Reserve. That also sparked fears that the Fed may not be able to contain inflation without causing a recession, which would increase the risk of default by shaky borrowers.

- “The macroeconomic outlook has deteriorated rather swiftly, and growth expectations have continued to decline,” Brad Rogoff, head of global fixed income research at Barclays, wrote on Friday.

- The primary market continued to remain generally frozen amid rising cost of debt, fueled by uncertainty over the Fed and the economic outlook.

- New bond sales volume has plunged, with year-to-date sales at $56.9b, a 75% drop from a year earlier and the lowest for the period since 2009.

(Bloomberg) Powell Wins Senate Confirmation for Second Term as Fed Chair

- The Senate voted to confirm Jerome Powell for a second four-year term as Federal Reserve chair on Thursday, trusting him to tackle the highest inflation to confront the country in decades.

- The overwhelmingly bipartisan 80-19 vote comes as the Fed grapples with soaring prices amid criticism it was slow to act against a threat that’s angered Americans and hammered President Joe Biden’s popularity.

- Powell’s Fed began raising interest rates in March and says it will keep going until price pressures cool, seeking a soft landing that doesn’t crash the economy. But critics doubt the central bank can avoid a recession as it tightens monetary policy that had been eased dramatically during the pandemic.

- “Few institutions are more important to help steer our economy in the right direction and to fight inflation than the Fed,” Senate Majority Leader Chuck Schumer said on the Senate floor earlier in the day. “Chairman Powell presided as Fed chair during some of the most challenging moments in modern American history.”

- Powell, 69, is Biden’s fourth Fed nominee to win confirmation. Economist Philip Jefferson was confirmed with bipartisan support on Wednesday. Lisa Cook, who was opposed by Republicans, won confirmation by the narrowest margin on Tuesday with Vice President Kamala Harris providing the tie-breaking vote. Lael Brainard was confirmed as Fed vice chair last month.

- Powell, a Republican nominated for Fed jobs by both Democrat Barack Obama and Republican Donald Trump, is a former Carlyle Group partner and worked as a Treasury official during the administration of George H.W. Bush. He earned a law degree from Georgetown University, making him a rare non-economist to lead the Fed in recent decades.

- Powell had near-unanimous backing in the Senate Banking Committee. Only Massachusetts Democrat Elizabeth Warren opposed him there, saying his record on deregulating financial institutions made him dangerous.