CAM Investment Grade Weekly Insights

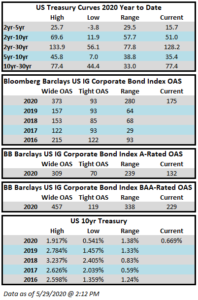

Spreads moved significantly tighter throughout the week. The Bloomberg Barclays US Corporate Index closed on Thursday May 28 at 175 after closing the week of May 22 at 185. The corporate index total return for the year through Thursday was +2.54%.

The primary market was busy again but volume was lower for the second consecutive week. This week saw over $38bln price in the primary market. Corporate issuance has now passed the $1 trillion mark for 2020 and it has done so at its fastest pace ever. New issue concessions have steadily declined in recent weeks and even turned negative for some deals in the latter half of this week. Strong inflows into the IG markets are the driving factor behind narrowing (and negative) concessions.

According to data compiled by Wells Fargo, inflows for the week of May 21-27 were +$11.5bln which brings the year-to-date total to -$43.7bln. This extends the 8-week steak of inflows to $55bln for investment grade funds.