CAM Investment Grade Weekly Insights

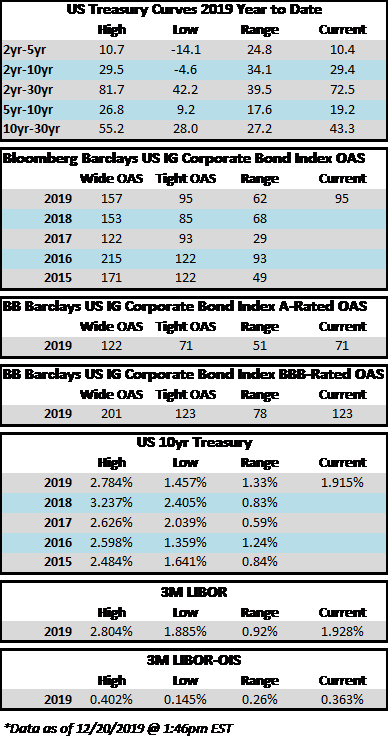

Another week has come and gone and corporate bonds continue to inch tighter into year end. The OAS on the Bloomberg Barclays Corporate Index opened the week at 99 and closed at 95 on Thursday. Spreads are now at their tightest levels of 2019 and the narrowest since February of 2018 when the OAS on the index closed as low as 85. Price action in rates was relatively muted during the week amid low volumes but Treasuries are set to finish the week a few basis points higher. The 10yr opened the week at 1.87% and is trading at 1.91% as we go to print.

As expected, the primary market during the week was as quiet as a church mouse. December supply stands at a paltry $18.9bln according to data compiled by Bloomberg. 2019 issuance stands at $1,110bln which trails 2018 by 4%. As we look ahead to 2020, we expect robust supply right of the gates in January but the street consensus for 2020 as a whole is that supply will be down 5% relative to 2019. Further, net supply, which accounts for issuance less the 2020 maturity of outstanding bonds, will be down substantially from prior years. If these forecasts come to fruition then the supply backdrop could lend technical support to credit spreads in 2020. Supply, however, is merely one piece of the puzzle.

According to Wells Fargo, IG fund flows during the week of December 12-18 were +$0.85bln. This brings YTD IG fund flows to +$295bln. 2019 flows are up over 11% relative to 2018.