CAM Investment Grade Weekly Insights

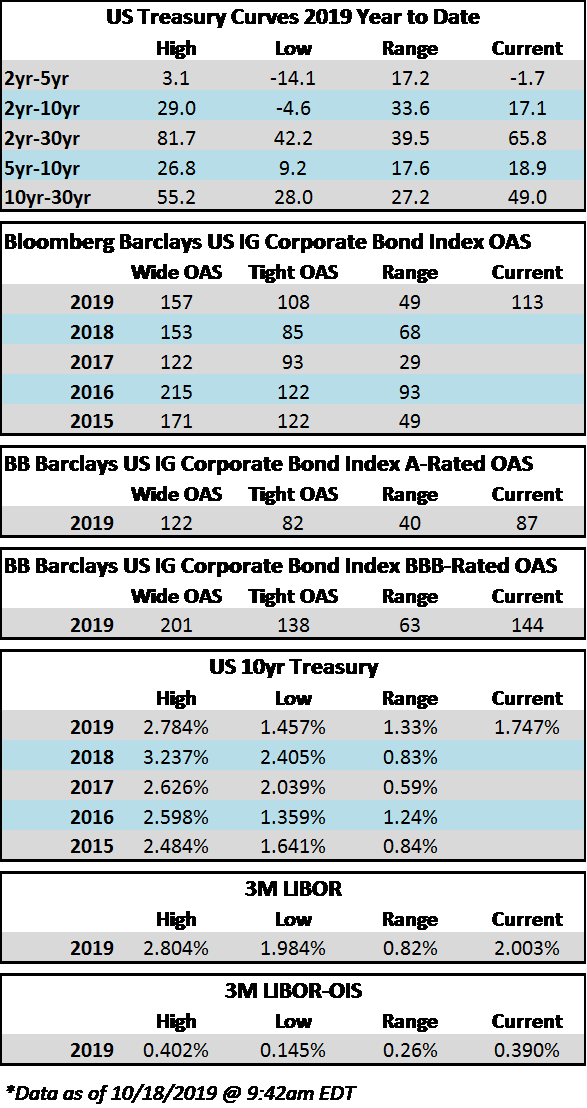

Spreads are tighter on the week amidst positive vibes in risk markets and the lack of meaningful new corporate supply. The OAS on the Bloomberg Barclays Corporate Index is 113 on Friday morning after having closed at 115 the week prior. Treasury rates have risen substantially since the beginning of October and the 10yr spent much of the week wrapped around 1.75%.

The primary market was subdued during the shortened week as the bond market was closed Monday for a federal holiday. Weekly new issue volume was $10bln pushing the monthly total to $25.8bln according to data compiled by Bloomberg. 2019 issuance stands at $949bln.

According to Wells Fargo, IG fund flows during the week of October 10-16 were +$4.3bln. This brings YTD IG fund flows to +$238bln. 2019 flows are up 9% relative to 2018.

(Bloomberg) Chief of Exelon Utility Business Retires Amid Federal Probe

- The head of Exelon Corp.’s utility unit has abruptly retired amid a federal probe involving its lobbying in Illinois.

- Anne Pramaggiore, senior executive vice president and chief executive officer of Exelon Utilities, is leaving “effective immediately,” the company said in a statement Tuesday. Calvin Butler Jr., chief of Exelon’s Baltimore Gas and Electric utility, was named as her interim replacement.

- Pramaggiore’s departure comes less than a week after Exelon disclosed in a regulatory filing that it received a subpoena from federal prosecutors asking for information related to communications with Illinois State Senator Martin Sandoval. In July, Exelon disclosed it received a subpoena related to its lobbying activities in Illinois.

- The Chicago Tribune reported earlier this month that federal agents had raided Sandoval’s office and were searching for information related to concrete and construction businesses and lobbyists and public officials. Officials were also looking for “items related to any official action taken in exchange for a benefit,” the Tribune reported, citing documents released by the Illinois Senate.

- Exelon’s statement on Pramaggiore’s retirement Tuesday didn’t reference the subpoenas. Nor did it give a reason for her departure.

- “We thank Anne for her valuable service,” Exelon CEO Chris Crane said in the statement. “We are confident this will be a smooth transition.”

(Bloomberg) High-Grade Corporate Bonds Trade Tighter as New Debt Sales Slump

- Spreads on new high-grade corporate bonds tightened in secondary trading as debt issuance missed estimates for the fourth straight week.

- Further outperformance in a market that has already enjoyed a 13% return this year should continue given the dearth of new supply and consistent fund inflows

- Investors added $2.9 billion for the week ended Oct. 16, Refinitiv’s Lipper US Fund Flows data show, adding to $1.8 billion the prior period

- All eight of the fixed-rate tranches sold this week are trading tighter, according to Trace data reviewed around 10 a.m. on Friday

- Primary market sales disappointed again this week, with just $10 billion priced against estimates calling for $15 billion to $20 billion

- 40% of this week’s volume was from one borrower — Bank of America’s $4 billion priced in two parts

- Seven of eight bonds sold this week were from financial companies

- Next week’s preliminary forecast calls for a total in the $15 billion area, with the possibility for an upside surprise should more banks come to the market

- With 27% of the S&P 500 index companies reporting earnings next week, more corporate issuance is expected

- Financial companies have dominated recent weeks

- Further outperformance in a market that has already enjoyed a 13% return this year should continue given the dearth of new supply and consistent fund inflows