CAM Investment Grade Weekly Insights

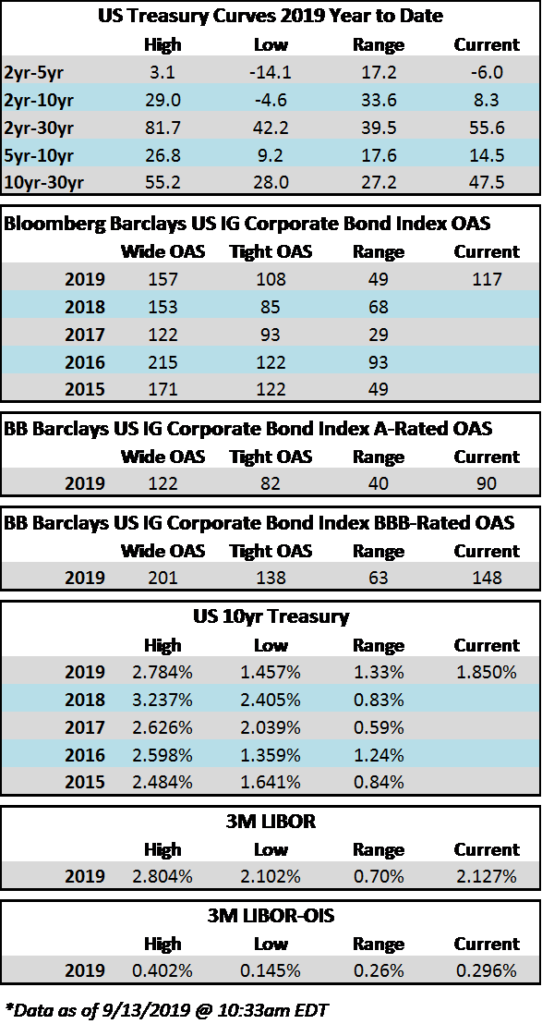

Spreads are set to finish the week modestly tighter while Treasuries are at the forefront with the 10yr now 30 basis points higher from last Friday’s close of 1.560%. The OAS on the corporate index closed at 117 on Thursday after closing the prior week at a spread of 119. Equity indices are trading near or above all-time highs as risk markets cling to any glimmer of hope or positive headline that might indicate U.S.-China trade progress. At CAM we remain skeptical of a near term trade resolution and are cautious in our positioning as a result.

The primary market had another strong week after posting its busiest week ever in the previous weekly session. Nearly $42bln of new corporate debt was brought to the market making it the 3rd busiest week of the year according to data compiled by Bloomberg. Monthly volume has topped $116bln while year-to-date corporate supply stands at $882bln. After having trailed 2018 issuance by as much as 13% in June, 2019 year-to-date issuance is now down just 2% from the prior year. It will be interesting to see how the violent move higher in rates may affect the primary market going forward as higher rates may serve to delay some issuance as borrowers weigh funding costs relative to long term capital allocation plans.

According to Wells Fargo, IG fund flows during the week of September 5-11 were +$7.2bln, the second largest inflow on record. This brings YTD IG fund flows to +$209bln. 2019 flows to this juncture are up 8 % relative to 2018.

(Bloomberg) Investment Grade New Issues Trade Tighter Despite Supply Surfeit

- Demand for U.S. investment-grade credit is robust, with this month’s avalanche of high-grade bond sales trading mostly stronger, data compiled by Bloomberg show. Spreads on the vast majority of deals priced last week and sized at $1 billion or more are tighter.

- 20 out of 21 bonds sampled were tighter as of Friday morning

- Average change in spread was 8 basis points

- 20 out of 21 bonds sampled were tighter as of Friday morning

(Bloomberg) Fed Seen Cutting Rates Twice More in 2019 Before Holding Steady

- U.S. central bankers will trim interest rates by a quarter percentage point next week, and again in December, before leaving the target range for their benchmark rate at 1.5%-1.75% for an extended period, according to economists surveyed by Bloomberg.

- In the Sept. 9-11 poll of 35 economists, respondents lowered their projections for the path of U.S. rates compared to a similar survey in July. However, they firmly rejected the idea the Federal Reserve had begun a series of moves that will prove more prolonged than the “mid-cycle adjustment” that Chairman Jerome Powell predicted in July, when the Federal Open Market Committee cut for the first time in more than a decade.

(Bloomberg) Elliott’s $3.2 Billion AT&T Bet Signals ‘There Will Be a Fight’

- AT&T Inc.’s sweeping transformation from Ma Bell to a multimedia titan has gone both too far and not far enough for Elliott Management Corp.

- Billionaire Paul Singer’s New York hedge fund disclosed a new $3.2 billion position in AT&T, taking on one of the nation’s biggest and most widely held companies with a plan to boost its share price by more than 50% through asset sales and cost cutting.

- Elliott outlined a four-part plan for the company in a letter to its board Monday. The proposal calls for the company to explore divesting assets, including satellite-TV provider DirecTV, the Mexican wireless operations, pieces of the landline business, and others.

- AT&T is the most indebted company in the world — not counting financial firms and government-backed entities — with $194 billion in total debt as of June, a legacy of Stephenson’s steady clip of large acquisitions. The CEO used to keep a spreadsheet of a few dozen companies that he studies on his tablet to plan his next big deal, people familiar with the matter told Bloomberg in 2016.