CAM Investment Grade Weekly Insights

Fund Flows & Issuance: According to Wells Fargo, IG fund flows for the week of May 3-May 9 were positive, with an inflow of $912 million. According to data analyzed by Wells Fargo, IG funds have garnered $60.031 billion in net inflows YTD.

According to Bloomberg, $44.039bn in new corporate debt priced during the week. This brings the YTD total to $478.934bn. Per Bloomberg, this has been the highest weekly volume total since the week ended March 9, which included the $40 billion 9-part CVS deal to fund the Aetna transaction.

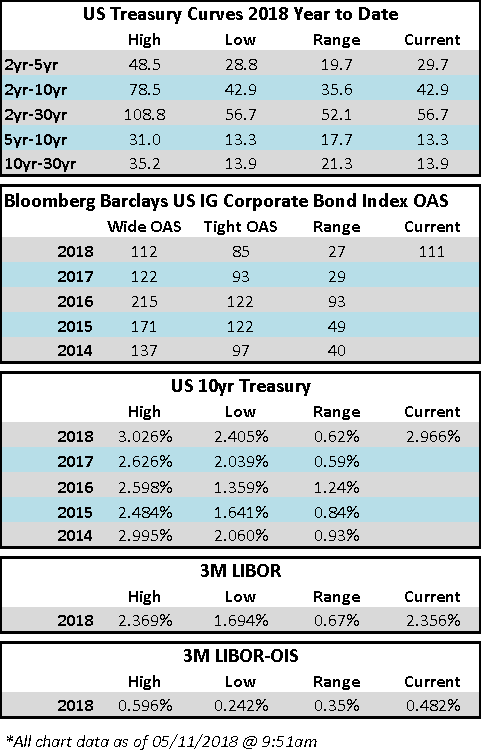

(Bloomberg) U.S. Yield Curve Flattest Since August 2007 as Long Bonds Soar

- The Treasury yield curve from 5 to 30 years flattened Thursday to the lowest level since August 2007, as a combination of weaker-than-expected U.S. inflation and solid demand for a record bond auction bolstered investor confidence in owning long-dated securities.

- The spread narrowed by more than 4 basis points, the most since February, dropping through a previous intraday low from April to 27.7 basis points. The gap between 2- and 10-year Treasuries also shrank in a bull flattening move.

- Investors and Federal Reserve officials alike have been on guard for the curve flattening toward inversion, which has historically preceded recessions. Yet bond traders are still pricing in more than two additional quarter-point rate hikes by year-end, betting policy makers will stick to their tightening path.

(WSJ) Cord-Cutting Pain Spreads to High-Yield Bond Market

- The consumer stampede to streaming media from traditional broadcasters is claiming an unexpected victim: high-yield bond investors.

- Telecommunications, cable and satellite companies have borrowed hundreds of billions of dollars in junk debt to build networks that would allow them to dominate their markets for decades to come.

- The proliferation of internet-based providers is upending that expectation, forcing investors to question the safety of bonds they bought from companies such as satellite broadcaster Dish Network, cable giant Charter Communications, and landline telecommunications company Frontier Communications.

- Defaults are low right now in telecommunications and media bonds, and some companies that offer broadband and wireless access actually benefit from the move toward streaming media.

(Bloomberg) U.S. Economic Growth Can Withstand the Threat From Rising Prices

- Want ads for truck drivers to haul crude oil in Texas are touting salaries as high as $150,000 a year. Some nurses are getting $25,000 signing bonuses. The U.S. unemployment rate just fell to 3.9 percent, one tick away from its lowest since the 1960s. And on May 8 the Bureau of Labor Statistics reported there are 6.5 million unfilled jobs in the U.S., the most on record. Some employers say they’re feeling the squeeze. “Rising labor costs remain the primary contributing factor to our margin erosion,” Chatham Lodging Trust, a company in West Palm Beach, Fla., that owns more than 130 hotels either by itself or in joint ventures, said on May 1.

- Is the U.S. economy overheating? Yes and no. There are plenty of inflationary bottlenecks, and not only in the labor market. Backlogs of orders are the highest since 2004, according to the Institute for Supply Management. Transportation costs have jumped in part because of driver shortages. Strong U.S. oil and gas production has helped push up the prices of essential inputs such as steel pipe and specialty sands used in fracking.

- On the other hand, the bottlenecks aren’t yet causing high inflation across the economy, which would require the Federal Reserve to speed up its interest rate hikes. The U.S. central bank passed up the opportunity to raise the federal funds rate at its May 1-2 meeting while noting that the rate of inflation has “moved close” to the bank’s 2 percent target. “In my judgment, the Fed is ready to accelerate [rate hikes] if they need to, but they’re not getting ahead, which I think is appropriate,” says Josh Wright, chief economist at ICIMS Inc., which makes software to find and hire talent.

- Some of the factors driving up the U.S. inflation rate—in particular, the jump in crude oil prices to about $70 a barrel from less than $50 a year ago—have external causes and don’t reflect overheating in the domestic economy. Rising commodity prices caused in part by new steel tariffs cost General Motors Co.and Fiat Chrysler Automobiles NV at least $200 million each in the first quarter. Tariffs have also helped drive lumber prices to a record. Other external factors are the high price of imported alumina for aluminum smelters and the weather-related runup in prices of vanilla from Madagascar and cocoa from Ivory Coast and Ghana.

- The U.S. economy performed below capacity for so long that it can be hard for managers to remember how to operate without lots of spare resources. Half of the surveyed members of the National Federation of Independent Business say there are “few or no” qualified workers for job openings. Yet on May 8 the NFIB reported that in April the net percentage of small-business owners who reported improved earnings trends was the highest in the survey’s history. “There is no question that small business is booming,” William Dunkelberg, NFIB’s chief economist, said in a statement. (Big companies are, too: First-quarter earnings for companies in the S&P 500 are expected to be 24 percent higher than a year earlier, Bloomberg calculated on May 9.)

- Sectors with strong pay growth generally confront special circumstances. Those truck drivers being offered as much as $150,000? They’re being hired by oil producers in the Permian Basin who are desperate to get their crude to market. Hospitals, whose median expenditures for contract labor rose 19 percent in the past year, face their own special problems, according to John Morrow, a managing director of Franklin Trust Ratings who analyzes hospitals. People whose skills are in high demand and work under temporary contract rather than salary can take full advantage of shortages for their talents, according to Morrow. “This is a level of skill that requires advanced-level training that involves medicine, technology, and science, and all of those things are costly,” he says.

- An important sign that rising costs remain manageable is that most companies haven’t passed them along to customers. Walmart Inc., the nation’s largest private employer, raised starting wages to $11 an hour in January and announced annual bonuses of as much as $1,000. But it’s cutting prices to remain competitive with Amazon.com Inc. and low-cost supermarket chains Aldi Inc. and Lidl US LLC. The same goes for packaged-goods companies. General Mills Inc. has acknowledged that attempts to hike prices for its Progresso soup and Yoplait yogurt ultimately hurt sales by driving shoppers to other brands. In freight transportation, BNSF Railway Co. has picked up market share from Union Pacific Corp. by underpricing it.

- “We have to be a little bit cautious in inferring that wage growth is going to be a major constraint for business,” says Gregory Daco, head of U.S. macroeconomics for Oxford Economics Ltd. While some economists warn that rising inflation is a “late-cycle” phenomenon—i.e., a precursor of recession—“we don’t have clear evidence that we’re at the end rather than the middle of the cycle,” says Michael Englund, chief economist of Action Economics LLC in Boulder, Colo.

- A key statistic to watch is unit labor costs, which are wages adjusted for productivity. They rose at an annual rate of 2.7 percent in the first quarter. But over the past year as a whole, the increase was only 1.1 percent. As long as companies’ unit labor costs don’t rise faster than the prices they charge, tight labor markets won’t be a problem.

- The Fed’s preferred measure of inflation, the price index for personal consumption expenditures, is going to look high for a few months because a brief dip in prices for clothing, hotel rooms, airline fares, and other items has ended, says Ian Shepherdson, chief economist of Pantheon Macroeconomics. That might influence the Fed, he says. There’s a risk that Fed rate setters could react too quickly to signs of overheating. “As inflation climbs, so too will the risk of recession, because at some point policymakers will feel impelled to respond,” Ellen Zentner, chief U.S. economist of Morgan Stanley, wrote in a note to clients on May 2.