Q3 2018 Investment Grade Commentary

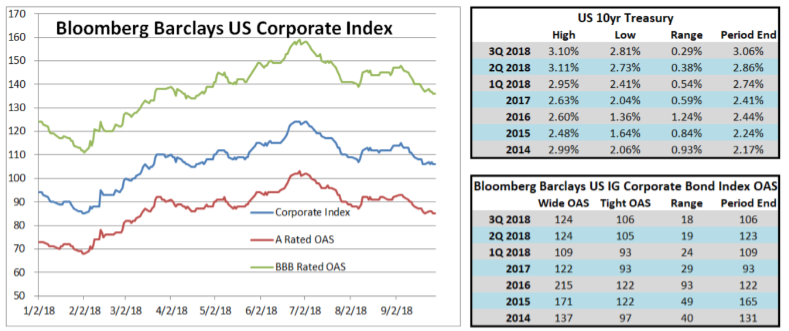

The theme of the third quarter was tighter spreads and higher rates. The spread on the Bloomberg Barclays US Corporate Index started the quarter at a year-to-date high of 124, at which point spreads began to march tighter, with the index finishing the quarter at an OAS of 106. The 10yr Treasury started the quarter at 2.86% before finishing at 3.06%. All told, movements in spreads and rates were nearly a wash, as the 18 basis point tightening of the index was not quite enough to offset a 20 basis point rise in the 10yr Treasury. It was a “coupon-like” type of return for corporate bonds during the quarter as the US Corporate Index posted a positive quarterly total return of +0.97%. This compares to CAM’s gross quarterly return of +0.84%. Through the first 9 months of the year, the US Corporate Index has posted a -2.33% total return, while CAM’s gross total return was -2.13%.

There was a flight to quality in the second quarter that was beneficial to CAM, but that trend reversed in the third quarter. Recall that CAM limits itself to a 30% weighting in BBB-rated credit, which is the lower tier of credit quality within the US Corporate Index, while the index itself had a 49.13% weighting in BBB-rated credit at the end of the third quarter. The BBB-rated portion of the index saw its spread tighten 22 basis points during the quarter, which was 5 basis points better than the 17 basis points of tightening that the A-rated portion of the index experienced. Because CAM targets a 70% weighting in higher quality credit, the gross performance of CAM’s portfolio trailed the index by 0.13% during the quarter. We at CAM are perfectly comfortable, even enthused, by our underweight in lower quality credit. CAM was founded in 1989, so we have seen each of the last three credit cycle downturns that have occurred in the past 30 years. We do not know when the current cycle will turn but we do know that we are 10+ years into the expansion period, and we also know that it is inevitable that the cycle will turn at some point. Most of all, we are not currently seeing enough value in the lower tier of investment grade rated credit. As a bottom up manager that is focused on fundamental research, we are currently finding enough good ideas to populate portfolios, but certainly not enough good ideas to approximate the 50% index weighting in BBB-rated credit. We intend to continue to keep our structural underweight on the riskier portions of the investment grade rated universe and we expect that by doing so that our client portfolios will experience lower volatility and higher returns over the long term.

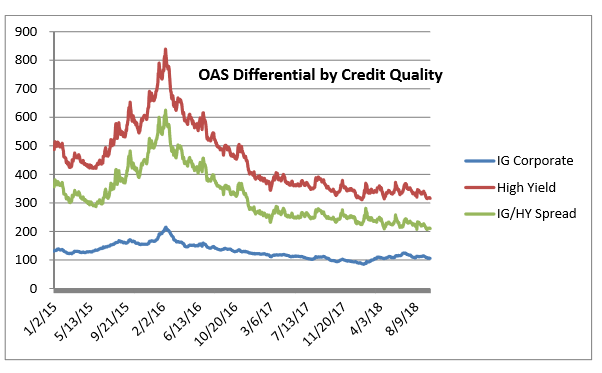

Yields in the riskiest portions of the corporate bond market may not be currently providing enough compensation for investors (see chart below). On September 19th 2018, the spread between the US Corporate Index and US High Yield Index reached a multi-year low of 207 basis points. This means investors were being compensated just an extra 2.07% to own high yield bonds versus investment grade bonds. This differential finished the quarter at 2.10%, not far off the lows. To put this into perspective, the premium afforded by high yield bonds was as high as 6.25% as recently as February 11, 2016. September 2018 marks the lowest spread between high yield and investment grade since July of 2007, which was just prior to the 2007-2008 credit cycle downturn. Again, we feel like there are certainly some risks worth taking in credit, but there are not so many good investments available that the riskiest portions of the corporate bond universe should be trading at near historical lows relative to the much less riskier portions.

The Federal Reserve raised the Fed Funds Target Rate at its September meeting. This marks the 8th increase in the target since the current tightening cycle began in December of 2015. The current implied probability of a Fed rate hike at the December 2018 meeting is 70.1%i. Fed policymaker forecasts envision short term rates at 3.1% by the end of 2019 which implies a hike in December of this year and two additional hikes throughout 2019ii. In our second quarter commentary, we wrote extensively about the flattening of the Treasury curve relative to the steepness of the corporate credit curve. Our positioning has not changed, and we intend to continue to position the portfolio in intermediate maturities that mature within 5-10 years. We believe that, over the medium and longer term, investors are most appropriately compensated for credit risk and interest rate risk by investing in intermediate maturities and that is largely due to the historically reliable steepness of the corporate credit curve. We are also firm in our belief that investors should spend time focusing on risks that can be managed, like credit risk, and spend far less time trying to tactically reallocate their portfolios in response to risks that are fraught with unpredictability, like interest rate risk.

As we look toward the fourth quarter, we expect a relatively sanguine environment for investment grade credit spreads. Companies should continue to reap the benefits of tax reform and a healthy macroeconomic backdrop for the next few quarters. According to data compiled by FactSet, corporate earnings for the second quarter of 2018 featured the highest number of S&P 500 companies reporting earnings per share above consensus estimates since the data first began being tracked in the third quarter of 2008iii. We expect that earnings in the 3rd and 4th quarters will also be strong, but at some point they will be unable to keep pace with the strength of prior quarters and we wonder how investors will respond. The fourth quarter brings with it far more questions than answers. Will the Fed continue its tightening path in December, and if so, can the economy shoulder the burden of Treasury rates that have the potential to go higher? What surprises are in store for the markets regarding global trade

policy? We are in the midst of the longest economic expansion on record – just how long can it continue? We believe that there are plenty of opportunities in investment grade credit, but that now is the time for prudent risk taking and preservation of capital, which are cornerstones of our strategy. Although investment grade credit has seen negative returns for the first 9 months of the year, we support the thesis that the asset class can be part of the bedrock in the framework of an overall asset allocation and can offer attractive risk adjusted returns over medium and longer term time horizons. As the saying goes, “failing to prepare is preparing to fail”, and now is a time for de-risking bond portfolios instead of being unduly concerned with missing out on upside.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

i Bloomberg 10/1/2018 3:53pm EDT ii FRED Economic Data, FOMC Summary of Economic Projections for the Fed Funds Rate, Median, 10/1/2018 iii FactSet, September 7th 2018, “Record‐High Percentage of S&P 500 Companies Beat EPS Estimates For Q2”